Financial Guarantee:

Meaning: A contract that requires the issuer (Guarantor) to make specified payments to reimburse the holder (loan giver) for a loss it incurs because a specified debtor (loan taker) fails to make payment when due in accordance with a debt instrument.

Condition for classifying an instrument as financial guarantee:

Payment to be made to holder only if:

- The holder suffers loss due to non-payment of a debt instrument and,

- Compensation amount does not exceed the loss suffered.

If above both conditions are not satisfied, the instrument is not a financial guarantee.

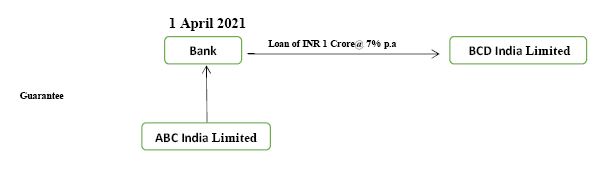

Practical illustration:

Let’s understand the accounting of financial guarantee as per Ind AS 109:

ABC India Limited has issued Financial Guarantee to Bank for the Loan taken by BCD India Limited. Had there been no guarantee, the bank would have given loan to BCD @ 10% per annum, this is due to enhanced credit worthiness of loan. Interest to be paid at the end of each year and the principal is repaid at the end of the loan period.

Scenario 1

ABC India Limited has charged a commission of INR 7.5 lakhs for the guarantee it has issued to bank.

Scenario 2

No commission is charged by ABC India Limited for issuing guarantee to the bank.

Question- How the financial guarantee shall be initially recognised in books under Ind AS under both the scenarios?

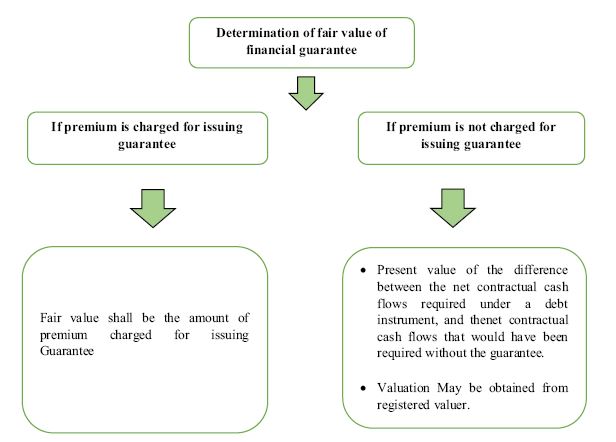

Answer- As per para 5.1.1 of Ind AS 109, initial recognition of the financial guarantee shall be made at its fair value. Fair value of financial guarantee shall be determined using below approaches:

Scenario 1 (Where premium is charged for issuing Guarantee)– Initial Recognition

Initial Recognition at fair value i.e., the amount of commission received.

| Date | Journal Entry | Dr | Cr |

| 01-Apr-21 | Bank | 7,50,000 | |

| 01-Apr-21 | To Financial Guarantee (Financial Liability) | 7,50,000 |

Scenario 2 (Where NO premium is charged for issuing Guarantee)– Initial Recognition

Financial Guarantee must be recognised at fair value. The Fair value of guarantee will be the present value of the difference between the net contractual cash flows under the loan, and the net contractual cash flows that would have been required without guarantee.

Calculation of Fair value of Guarantee

| Particulars | Year 1 | Year 2 | Year 3 | Total |

| Cash outflow based on interest rate of 10% | 10,00,000 | 10,00,000 | 10,00,000 | 30,00,000 |

| Cash outflow based on interest rate of 7% | 7,00,000 | 7,00,000 | 7,00,000 | 21,00,000 |

| Differential interest | 3,00,000 | 3,00,000 | 3,00,000 | 9,00,000 |

| Present value of differential Interest @10%**i.e., fair value | 2,70,000 | 2,50,000 | 2,30,000 | 7,50,000 |

** Interest rate differential shall be discounted using the market rate of interest that would have to be paid, has there been no guarantee.

If BCD limited is related party, the journal entry shall be:

| Date | Journal Entry | Dr | Cr |

| 01-Apr-21 | Investment in Subsidiary* | 7,50,000 | |

| 01-Apr-21 | To Financial Guarantee (Financial Liability) | 7,50,000 |

* This is deemed investment in subsidiary. Subsidiary company shall also book corresponding deemed equity infusion and both the entries shall be eliminated at consolidated financial statements level.

If BCD limited is not a related party, the journal entry shall be: .

| Date | Journal Entry | Dr | Cr |

| 01-Apr-21 | Guarantee Expense | 7,50,000 | |

| 01-Apr-21 | To Financial Guarantee (Financial Liability) | 7,50,000 |

SUBSEQUENT RECOGNITION

As at each year end, Subsequent measurements of financial guarantee need to be made at fair value, fair value shall be the determined as follow:

Assuming, probability of default is as follow:

| Date | Probability of default |

| On 31 March 2022 | 1% |

| On 31 March 2023 | 3% |

If BCD India Limited (Borrower) defaults in repayment of the loan due, ABC India Limited does not expect to recover any amount from BCD India Limited.

SUBSEQUENT RECOGNITION

On 31 March 2022- Higher of (a) or (b) below:

a) Amount of loss allowance: On 31 March 2022, there is 1% probability that BCD India Limited will default. This is not a significant increase in the probability of default from 1 April 2021. The 12-month expected credit losses are therefore: 1% of Rs. 1 Crore= Rs. 1 Lakh

b) The Initial amount recognised less amortisation:

| Amount | |

| Initial amount of financial guarantee as of 1 April 2021 | 7,50,000 |

| Add: Interest for the period 1 April 2021 to 31 March 2022 (750,000*10%) | 75,000# |

| Less: Amortisation of benefit provided over the period of loan (9,00,000/3) | 3,00,000$ |

| Closing balance as on 31 March 2022 | 5,25,000 |

# Interest shall be accrued at the market rate, i.e., the rate at which the borrower would have obtained the loan has there been no guarantee.

$ Total benefit that is received by the borrower due to this guarantee by the issuer (ABC India Limited) by way of reduction in the interest rate by 3% [See Calculation of fair value guarantee at the time of initial recognition] amortised over the life of financial guarantee (9,00,000/3)

Higher of (a) and (b) = Rs. 5,25,000

Therefore, carrying amount is to be adjusted to Rs. 5,25,000. Journal entry for this shall be:

| Date | Journal Entry | Dr | Cr |

| 31-Mar-22 | Financial Guarantee (Financial Liability) | 2,25,000 @ | |

| 31-Mar-22 | To Profit and Loss | 2,25,000 |

@ Reducing the financial liability from INR 7,00,000 to INR 5,25,000, and recognised gain of Rs. 2,25,000.

On 31 March 2023- Higher of (a) or (b) below:

a) Amount of loss allowance: On 31 March 2023, there is 3% probability that BCD India Limited will default. This is not a significant increase in the probability of default from 1 April 2021. The 12-month expected credit losses are therefore: 3% of Rs. 1 Crore= Rs. 3 Lakhs

b) The Initial amount recognised less amortisation:

| Amount | |

| Opening balance of financial guarantee as of 1 April 2022 | 5,25,000 |

| Add: Interest for the period 1 April 2022 to 31 March 2023 (5,25,000*10%) | 52,500# |

| Less: Amortisation of benefit provided over the period of loan (9,00,000/3) * | 3,00,000$ |

| Balance as on 31 March 2023 | 2,77,500 |

# Interest shall be accrued at the market rate, i.e., the rate at which the borrower would have obtained the loan has there been no guarantee.

$Total benefit that is received by the borrower due to this guarantee by the issuer (ABC India Limited) by way of reduction in the interest rate by 3% [See Calculation of fair value guarantee at the time of initial recognition] amortised over the life of financial guarantee (9,00,000/3)

Higher of (a) and (b) = Rs. 3,00,000

Therefore, carrying amount is to be adjusted to Rs. 3,00,000

| Date | Journal Entry | Dr | Cr |

| 31-Mar-23 | Financial Guarantee (Financial Liability) | 2,25,000 @ | |

| 31-Mar-23 | To Profit and Loss | 2,25,000 |

@ Reducing the carrying amount of financial guarantee from INR 5,25,000 to INR 3,00,000

Accounting treatment at the time of settlement of loan where there is no default

If there is no default at the time of settlement of loan, the issuer of guarantee (ABC India Limited in our example) of the loan shall derecognise the financial Guarantee from its books of account by passing journal entry as follow:

^ Carrying value as appearing in books of account as on March 31, 2023.

Accounting treatment if the borrower (BCD India Limited) defaulted in payment on due date i.e., March 31, 2024:

If the borrower (BCD India Limited) defaults in payment to the lender on due date (31, March 2024), the issuer of the guarantee (ABC India Limited) shall become liable to pay to the lender for the amount due (INR 1 crore in given case).

In such cases, the issuer of guarantee shall:

FIRST: – Re-measure the financial guarantee at the amount of actual liability i.e., INR 1 crore in given case.

THEN: – De- recognize the financial guarantee by either paying the due amount in cash or by recognizing the said amount as payables.

Following Journal entry shall be passed: –

| Date | Journal Entry | Dr | Cr |

| 31-Mar-24 | Profit and Loss | 97,00,000^ | |

| 31-Mar-24 | Financial Guarantee (Financial Liability) | 97,00,000 |

^ Re measuring the financial guarantee the amount of actual liability i.e., from INR 3 lakh to INR 1 crore

| Date | Journal Entry | Dr | Cr |

| 31-Mar-24 | Financial Guarantee (Financial Liability) | 100,00,000 | |

| 31-Mar-24 | To Bank/ABC India Limited | 100,00,000 |

First of all Thanks a lot for the Case Study. However, as for subsequent measurement entries, if in the Case Study, BCD Ltd (Company getting advantage of Guarantee) is a Subsidiary of ABC Ltd (Guarantor) then, for Annual De-recognition Entries, will Investment in Subsidiary Account be involved in place of Profit & Loss Account? If yes, then fine (kindly mention), but if not, then what will be the subsequent treatment of said Investment in Subsidiary Account – Kindly advise.

Regards,

CA P. Dasgupta