When a company orders and receives goods or services in advance of paying for them, we say that the company is purchasing the goods on account or on credit. The supplier of these goods and services on credit is also referred to as a creditor. If the company receiving the goods does not sign a promissory note, the vendor’s bill or invoice will be recorded by the company in its liability account Accounts Payable. As is expected for a liability account, Accounts Payable will normally have a credit balance.

Hence, Accounts payable refers to an account within the general ledger that represents a company’s obligation to pay off a short-term debt to its creditors or suppliers. The sum of all outstanding payments owed by one organization to its suppliers is recorded as the balance of accounts payable on the company’s balance sheet, whereas the increase or decrease in total AP from the period prior will appear on the cash flow statement

The role of the accounts payable department is to provide financial, administrative, and clerical support to an organization. The team is required to do a number of jobs including coding, approval, payment, and reconciliation of vendor invoices. A knowledgeable and well-managed accounts payable department can save an organization considerable amount of time and money with regard to the AP process.

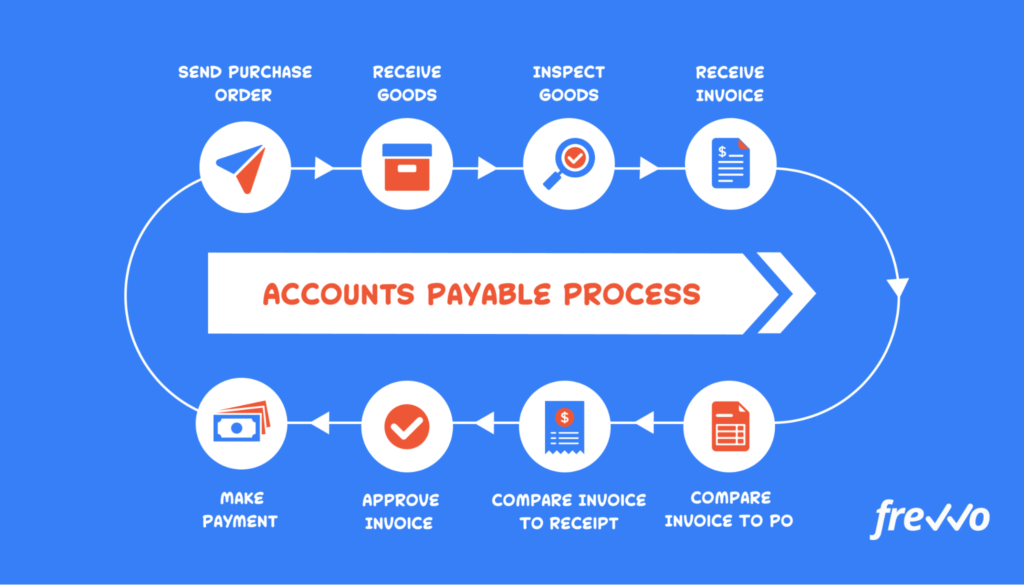

The process of accounts payable includes four distinct steps:

- Invoice Capture: involves the manual entering of invoice data into a system of record presenting risks associated with accuracy and human error.

- Invoice Approval: involves the review and approval of supplier invoices which happens prior to posting as a cost in the ERP and sending payment.

- Payment Authorization: Once you have an invoice that is ready for payment, you must get authorization to make the payment. This includes the date you will submit the payment, the payment method, and the payment amount.

- Payment Execution: Following payment authorization, the invoice is paid, and remittance details are sent to the vendor. Now the invoice can be closed out of the system and filed into various repositories.

Since the accuracy and completeness of a company’s financial statements are dependant on this process, it will include:

- The timely processing of accurate and legitimate vendor invoices,

- Accurate recording in the appropriate general ledger accounts, and

- The accrual of obligations and expenses that have not yet been completely processed.

Errors and inefficiencies in accounts payable processes can have lasting effects on a company. Identifying the specific challenges in invoice processing that your business faces today will open the door to smart improvements and sound investments. By transitioning away from manual processes involving paper invoices and toward AI-enabled digital workflows, businesses unlock significant benefits. Bookkeeping becomes more reliable, vendors always get paid on time and discounts make your operations more efficient.